Moderna

MRNA

announced that it entered a definitive agreement to acquire Japan-based OriCiro Genomics (“OriCiro”) for $85 million.

The acquisition of OriCiro looks like a strategic fit for Moderna, as the company is focused on expanding and boosting its mRNA-manufacturing capabilities. It expects OriCiro’s proprietary technologies to support its portfolio of mRNA-based therapeutics and vaccines.

OriCiro is focused on the development and commercialization of cell-free synthesis and amplification of plasmid DNA, which Moderna believes is a key component in mRNA manufacturing. OriCiro specializes in cell-free assembly and amplification technologies, offering an alternative to the conventional E. coli cloning process.

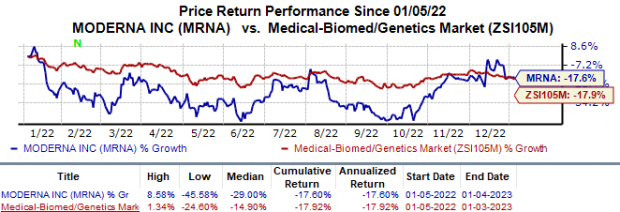

Shares of Moderna have declined 17.6% in the past one year compared with the

industry

’s 17.9% fall.

Image Source: Zacks Investment Research

Currently, Moderna generates all of its product revenues from the sale of its COVID-19 vaccines. The success achieved by the company in commercializing its COVID-19 vaccines has resulted in a significant boost to its cash resources. Moderna’s significant cash, cash equivalents, and marketable securities stood at approximately $17 billion at the end of September 2022.

As the effects of the pandemic have started to subside, Moderna has started to experience a declining trend in its COVID-19 vaccine sales. The trend is expected to continue in future quarters. As a result, the company has started to focus on its non-COVID pipeline and expand on that front.

Currently, Moderna has three late-stage candidates — mRNA-1647, mRNA-1345 and mRNA-1010 — in its pipeline, which are being developed as cytomegalovirus vaccine, respiratory syncytial virus vaccine and influenza vaccine, respectively. A successful development of any or all of these candidates and potential commercialization will help lower the company’s dependence on a single product for revenues.

Last month, Moderna, along with partner

Merck

MRK

, announced that the phase IIb KEYNOTE-942 study, evaluating their personalized cancer vaccine candidate mRNA-4157/V940,

achieved

its primary end-point of recurrence-free survival in melanoma patients.

Data from the above study showed that the combination of mRNA-4157 and Merck’s blockbuster cancer drug Keytruda exhibited a statistically significant and clinically meaningful reduction in the risk of disease recurrence or death by 44% compared with Keytruda alone.

Based on this data, Moderna and Merck plan to discuss these results with regulatory authorities. Merck and Moderna also intend to start a phase III study in melanoma patients later this year.

Zacks Rank & Stocks to Consider

Moderna currently carries a Zacks Rank #3 (Hold). A couple of better-ranked companies in the overall healthcare sector are

Allogene

ALLO

and

AVEO Pharmaceuticals

AVEO

, each currently carrying a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

In the past 60 days, estimates for Allogene’s 2022 loss per share have narrowed from $2.39 to $2.38. In the same period, the loss per share estimate for 2023 has narrowed from $2.84 to $2.82. Shares of Allogene have declined 57.8% in the past year.

Earnings of Allogene beat estimates in each of the last four quarters, witnessing an earnings surprise of 9.44%, on average. In the last reported quarter, Allogene’s earnings beat estimates by 6.45%.

In the past 60 days, estimates for AVEO Pharmaceuticals’ 2022 loss per share have narrowed from 76 cents to 68 cents. In the same period, earnings estimates for 2023 have risen from 46 cents per share to 52 cents. Shares of AVEO Pharmaceuticals have surged 233.5% in the past year.

Earnings of AVEO Pharmaceuticals beat estimates in three of the last four quarters, while missing the mark on one occasion, witnessing an earnings surprise of 19.87%, on average. In the last reported quarter, AVEO Pharmaceuticals’ earnings beat estimates by 43.75%.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report