The biotech sector was in focus with key pipeline and regulatory updates. Among these,

Geron Corporation

(GERN) soared on positive study data.

Recap of the Week’s Most Important Stories

:

Geron Surges on Study Results

: Shares of late-stage clinical biopharmaceutical company,

Geron Corporation

GERN

, surged after the company announced positive top-line results from its IMerge phase IIl study evaluating imetelstat. The candidate is being evaluated for lower-risk myelodysplastic syndromes (MDS) patients who are relapsed, refractory or ineligible for erythropoiesis stimulating agents (ESAs). The study met the primary 8-week transfusion independence (TI) endpoint and key secondary 24-week TI endpoint with highly statistically significant and clinically meaningful improvements.

Based on these results and data from earlier clinical trials, Geron plans to submit a new drug application (NDA) in the United States in mid-2023 and a Marketing Authorization Application (MAA) in the EU in the second half of 2023. The FDA has granted Fast Track designation to imetelstat for treating adult patients with transfusion-dependent anemia due to low or intermediate-1 risk MDS that is not associated with del(5q) who are refractory or resistant to an ESA. A request for rolling submission of the NDA was submitted and has been granted.

Chemomab NASH Study Meets Goal

:

Chemomab Therapeutics, Ltd

.

CMMB

announced its mid-stage study evaluating CM-101 in non-alcoholic steatohepatitis (NASH) patients was successful. CM-101 is a monoclonal antibody designed to bind and block CCL24 activity. The randomized, placebo-controlled phase IIa study enrolled 23 NASH patients with stages F1c, F2 and F3 disease, who were randomized to receive either CM-101 or placebo. Patients received eight doses of 5 mg/kg of CM-101 or a placebo, administered by subcutaneous (SC) injection once every two weeks for a treatment period of 16 weeks.

This trial was primarily designed to assess the subcutaneous formulation of CM-101 and to evaluate the drug’s impact on liver fibrosis biomarkers relevant to both NASH and rare fibro-inflammatory conditions such as primary sclerosing cholangitis (PSC) and systemic sclerosis (SSc). The trial met its primary endpoint of safety and tolerability, and CM-101 achieved reductions in secondary endpoints that include a range of liver fibrosis biomarkers and physiologic assessments measured at baseline and at week 20. Shares of the company gained on the news.

Phathom Declines on Regulatory Update

:

Phathom Pharmaceuticals, Inc

.

PHAT

announced that the FDA has notified the company that it will not take any action on the former’s new drug application (NDA) for vonoprazan on or before the target action date. Shares declined 31.11% on Jan 4 in response to the news. The NDA is currently under review seeking approval of the candidate for the treatment for erosive esophagitis. The current target action date is Jan 11, 2023.

In August, Phantom announced that it detected trace levels of a nitrosamine impurity, N-nitroso-vonoprazan (NVP), in commercial batches and was working closely with the FDA to obtain approval of a proposed acceptable daily intake limit, test method and controls to address this impurity prior to releasing vonoprazan-based products to the market. The FDA has set an acceptable daily intake limit for NVP at 96 ng/day. However, the FDA then requested additional stability data demonstrating that levels of NVP remain below that limit throughout the proposed shelf life of the product. Hence, the company is actively in the process of both generating additional stability data and discussing with the FDA the nature and extent of such requested data. As a result, Phathom no longer expects product launches for H. pylori or erosive esophagitis in the first quarter of 2023.

Phathom currently carries a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Vera’s Study Data

:

Vera Therapeutics, Inc

.

VERA

announced positive top-line data from the phase IIb ORIGIN study evaluating its lead product candidate, atacicept, for treating patients with immunoglobulin A nephropathy (IgAN). The double-blind, placebo-controlled ORIGIN study evaluated the safety and efficacy of atacicept in 116 patients with IgAN. Data from the same showed that treatment with atacicept led to a statistical significance in the 150 mg dose group with a 33% mean reduction in proteinuria from baseline at 24 weeks — the primary endpoint of the study. The safety profile of atacicept was similar to that of placebo in IgAN patients.

Vera plans to advance the development of atacicept into a pivotal phase III study in the first half of 2023 after discussions with the FDA. Despite the positive news, shares of Vera were down following the announcement of the news. Shares plunged further as data from the study supposedly were inferior to the rival company’s candidate.

Novavax Vaccine Study Initiation

:

Novavax

NVAX

initiated a phase II study to evaluate its COVID-19-Influenza Combination (CIC) and influenza standalone vaccine candidates. The mid-stage study will evaluate the safety, tolerability and immunogenicity of different formulations of the CIC and influenza vaccine candidates in adults aged 50 through 80 years. The study will be conducted in two parts and will enroll nearly 2,300 participants.

The CIC vaccine combines NVX-CoV2373, Novavax’s authorized protein-based COVID-19 vaccine, and its investigational influenza vaccine in a single formulation. Management believes that, like influenza, COVID-19 will be a seasonal infection and intends to target both indications through a single formulation. Management plans to announce initial data from this study in mid-2023. Based on this data, Novavax will decide whether to advance these candidates to late-stage development.

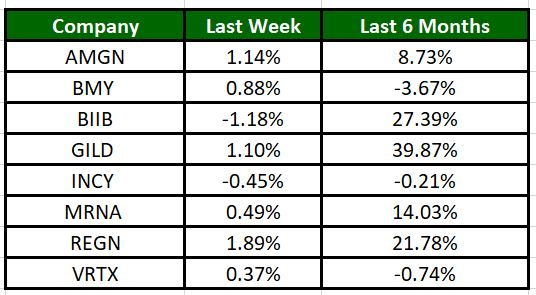

Performance

Image Source: Zacks Investment Research

The Nasdaq Biotechnology Index has gained 2.64% in the past four trading sessions. Among the biotech giants, Regeneron has gained 1.89% during the period. Over the past six months, shares of Gilead have soared 39.87%. (See the last biotech stock roundup here:

Biotech Stock Roundup: GILD’s HIV Drug Approval, PRQR Surges on LLY Deal & More

)

What’s Next in Biotech?

Stay tuned for other updates.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report